flow through entity tax break

50 of the W-2 wages paid by the qualified trade or business OR. That provides a 20 deduction that flows through to individuals.

Finally due to the nature of this retroactive application to 2021 tax situations quarterly estimated payments of tax otherwise due for tax year beginning in 2021 will not accrue any penalty or interest.

. Many owners of pass-through businesses especially landlords have no employees thus the 25 plus 25 deduction is of most benefit to them. The liability from the 50 percent withholding tax component of the pass-through entity tax was 397 million. Cost Segregation and Depreciation Recapture.

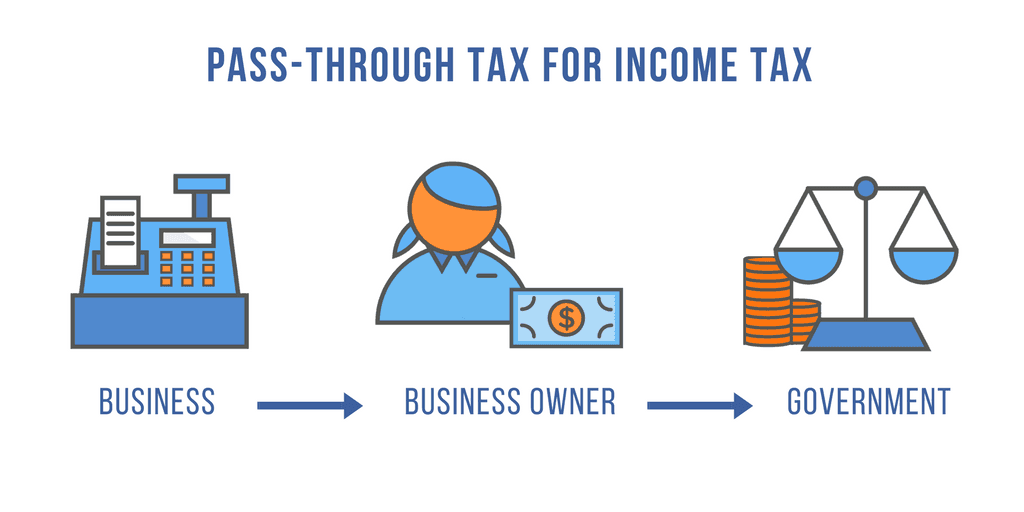

Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. What you may not know is that flow-through businesses are not just mom-and-pop shopsthey can be anything from a regional factory to a global accounting firm. In tax year 2000 there were 6334 pass-through entity tax returns filed.

Businesses are flow-through entities also known as pass-through entities who dont pay corporate taxes. About 95 percent of US. 20 of your Qualified Business Income.

Item 2 is 50000 25 x 500000 25 x 150000 50000. Thus the total tax year 2000 pass-through entity tax liability was 439 million. The 85 percent entity tax liability amounted to 42 million in tax year 2000.

It would be taxed at 37 tax rate as individuals are all taxed at. That is the income of the entity is treated as the income of the investors or owners. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships.

Which Income is Eligible for the Flow-Through Entity Tax Break Continued. Short Term Capital Gain Tax Workarounds. Using 401K for Property Investment.

Which Income is Eligible for the Flow-Through Entity Tax Break Continued. So a lower corporate tax rate doesnt do much for them. By doing so the entity will be voluntarily electing to pay an entity-level income tax on at least a portion of its profits allocated to its individual investors not corporations or other partnerships at graduated rates starting at.

Using 401K for Property Investment. Gretchen Whitmer earlier this year the Michigan House and Senate once again approved a bill aiming to help small businesses save more on their federal taxes. The annual return due date for flow-through entities remains the last day of the third month after the tax year Mar.

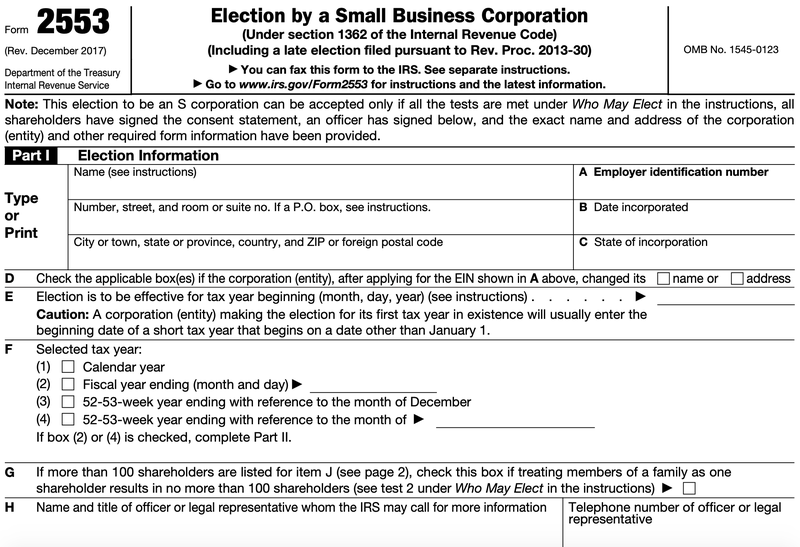

It offered a permanent reduction in tax rates for corporations to a top rate of 21 from 35. Gretchen Whitmer signed HB 5376 allowing eligible owners of pass-through entities to have the pass-through entity pay Michigan taxes at the entity level and then receive a refundable credit on their own tax return for their share of the entity level Michigan tax paid. Under New Yorks new PTE tax any entity taxed as a partnership or New York S Corporation may elect into the New York PTE tax system.

Item 1 is greater so their pass-through deduction is 75000. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has frustrated many business owners since it was passed in 2017 as part of the Tax Cuts and Jobs Act. Entity such as in the form of a branch or something like that that income is not subject to a special tax rate.

The Center Square After a veto from Gov. A flow-through entity is a legal entity where income flows through to investors or owners. Michigan pass-through entity owners are catching a federal tax break this year compliments of a bill signed this week by Governor Whitmer.

The majority of businesses are pass-through entities. Cost Segregation and Depreciation Recapture. The thing to keep in mind if those flow-through entities are doing business internationally lets say through the extension of their US.

The tax rate at the entity level the Varnum article explained is 425 the same as the individual income tax rate. Eligibility for Solo 401K. 312022 for calendar-year filers and penalty.

The Michigan House approved House Bill 5376 on a 100-3 vote while the Senate voted 34-2. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Common Types of Pass-Through Entities.

Legislature approves tax break for small businesses. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. For all entities other than a corporation there shall be allowed a deduction for any taxable year an amount equal to the sum of the lesser of.

Item 1 is 75000 50 x 150000 75000. Governor Whitmer signed HB. Vincenty-Medina said that UBS qualified for the 4 tax break on exporting its investment services to US.

The mess is still wending its way through courts and FINRA arbitration panels. Meanwhile President Joe Biden is unveiling his. The bill which passed state legislature with overwhelming bipartisan support allows owners of limited liability corporations S corporations and other pass-through entities with Michigan-sourced income to pay the state and local taxes.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. For individual owners the new provisions provide relief from the federal income tax. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships.

The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations. With an election in place and payment of the necessary taxes the pass-through entity can then deduct the amount of taxes paid without limitation on their federal tax returns Form 1120S for S corps Form 1065 for partnerships. Eligibility for Solo 401K.

Short Term Capital Gain Tax Workarounds.

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Pass Through Income Definition Example Investinganswers Financial Statement Analysis Income Definitions

Financial Reporting Under Ind As Profit And Loss Statement Financial Statement Financial

Whats The Pass Through Deduction The Owners Of Many Pass Through Entities Such As Partnership S C S Corporation Small Business Accounting Sole Proprietorship

A Complete Guide To The Singapore Corp Pass A New Digital Identity For Companies To Transact With The Gov Singapore Business Business Infographic Infographic

Pin By Stephanie Scott On Therapy In 2022 Successful Business Tips Money Management Advice Small Business Advice

Pass Through Entity Tax 101 Baker Tilly

7 Steps On How To Start A Business Checklist For Steady Growth Business Checklist Business Structure Bookkeeping Business

Benefits Of Incorporating Business Law Small Business Deductions Business

The Pros And Cons Of A Sole Proprietorship Business Brandongaille Com Business Structure Sole Proprietorship Business Law

Legal Entity Business Checklist Start Up Start Up Business

Pass Through Entity Definition Examples Advantages Disadvantages

Here Are Some Accounting Tips To Ensure An Error Free Accounting And Business Growth Accountingtips Accoun Cloud Accounting Accounting Accounting Software

A Beginner S Guide To Pass Through Entities The Blueprint

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

What The New Tax Bill Means For Small Business Owners Freelancers Business Tax Deductions Small Business Finance Business Tax

Pass Through Taxation What Small Business Owners Need To Know